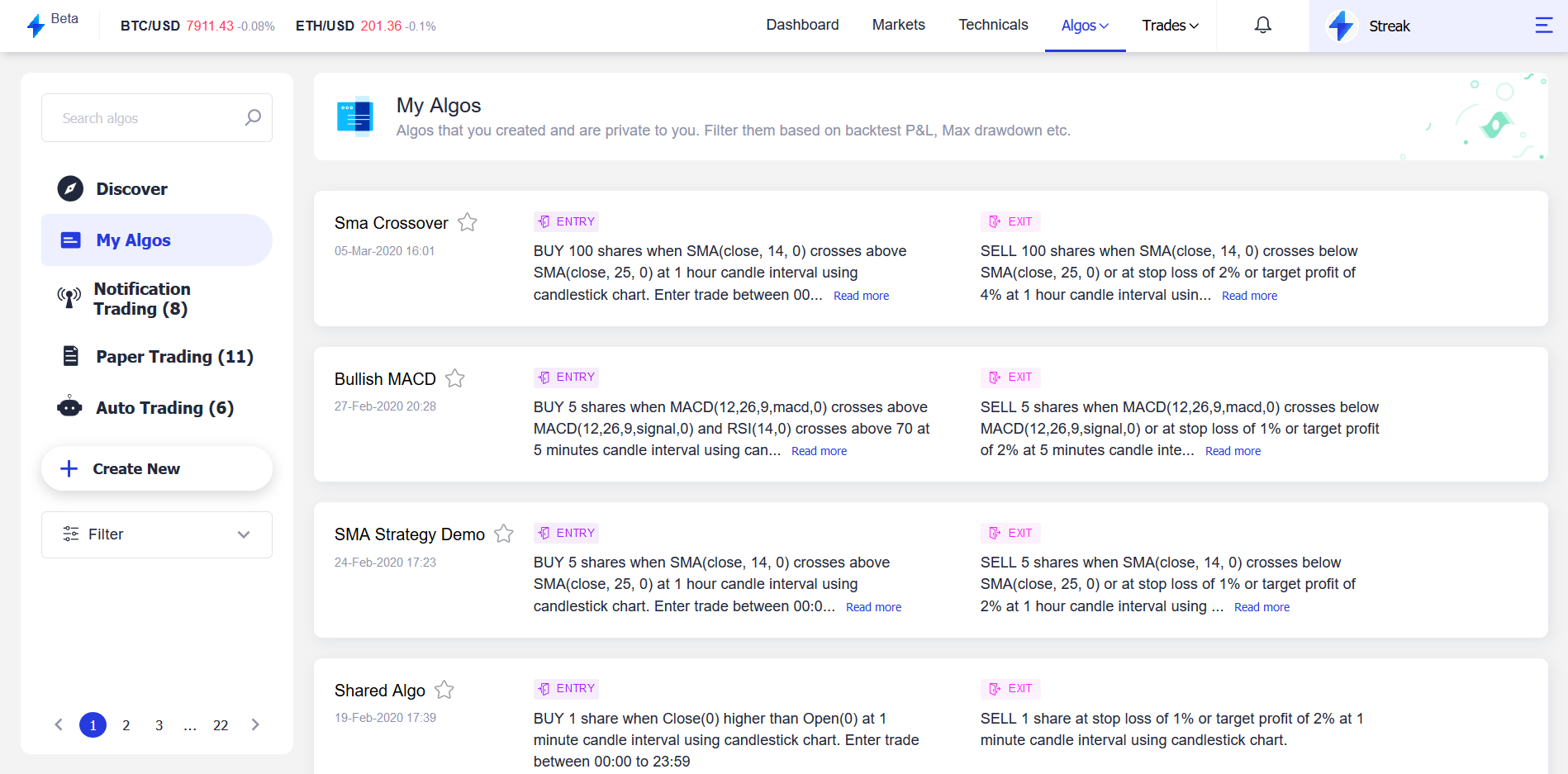

My Algos

My Algos page lists all the algos created by the user so far.

Each listed algo gives a summary of the respective algo. On clicking an individual algo it shows the list of all the scrips it was run on along with its backtest performance.

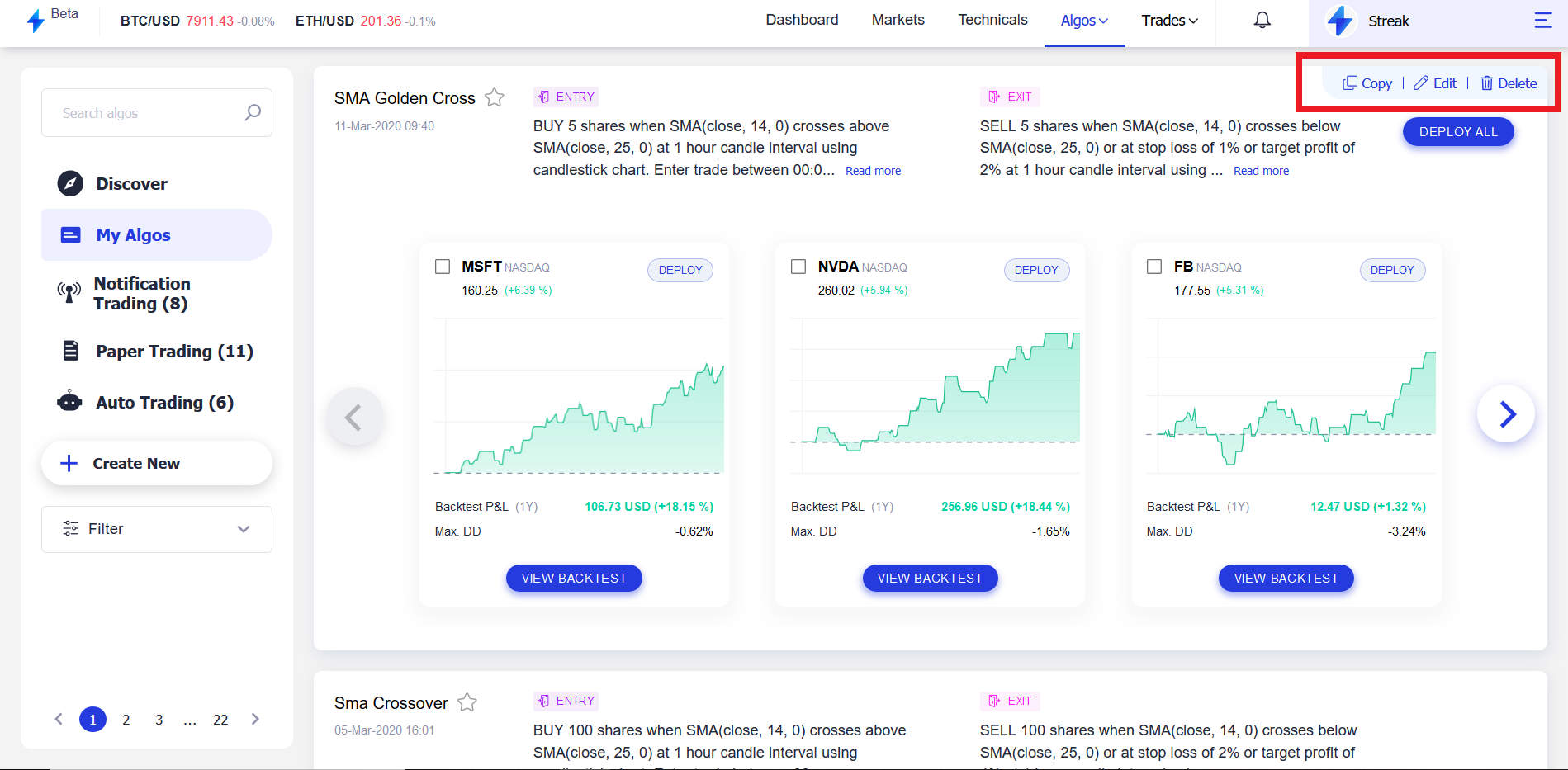

Algo Options¶

From the My algos page, each algo can be either edited, copied, deleted or backtest details can be viewed. To see the algo options hover over the algo you want to take action on, on the top right, the options will be visible.

Edit: To edit or modify the algo edit option can be selected, in case you want to fine-tune it even more or change the parameters like Stop loss, take profit percentage or add additional entry or exit indicator. After editing the algo its modified summary will be reflected immediately.

Copy: As the name suggests this option can be used to copy/fork the algo.

Delete: In case you want to delete the algo this option can be used.

Note

If any of the scrip of the algo is live i.e. deployed live in the market, the algo can neither be edited or deleted

View Backtest: This option takes you to the backtest page where complete details of individual scrip performance can be seen using this algo.

Deploy All: Prompts pre-deployment settings pop up window.

Deploy¶

Deploy allows users to take their algos live in the stock market and get actionable alerts based on the entry and exit conditions in their algo.

The deploy button is greyed out when no algos are selected on backtest or algos page. Once you select any algo by clicking on the checkbox the deploy button turns Blue. This means you have selected one or more scrips and you are ready to deploy.

On clicking the "Deploy" button on either Backtest or algos page, a popup is rendered with a summary of the user's algo with the entry condition, exit condition and candle interval. The user should also select the field "Algo cycle", which determines the period for which the algo will be live (algo cycle defines the loop of the algo: Entry followed by respective exit) and our systems will track market movements.

The user should select the deployment type (Paper/Notification/Auto Trading), Order type (Market/Limit/Post Only) and "Algo cycle" before clicking "Confirm".

Deployment Type: If Notification is selected, the platform will send an actionable notification based on the entry and exit conditions in their algo. If Auto Trading is selected, the platform will automatically execute orders, when entry and exit conditions are met. For simulation, you can select Paper trading.

Order Type: Limit orders are only executed at a specified price or better. Market orders execute the orders at the current market price (at any price). Post Only Orders are Limit Orders that are only accepted if they do not immediately execute (market maker orders). Market makers use Post Only Orders to only submit passive orders to earn the Maker rebate.

Algo Cycle: The algo cycle determines the number of times an algo will take an entry and its respective exit. Algo cycle defines the loop of the algo: Trade Entry followed by respective exit. For 1 cycle, the algo will trigger one Entry, Exit after which it will stop automatically. Maximum cycles allowed is 5.

For all algos, you have already created, you can deploy directly from the algos page without backtesting again. To do this you just need to go to the algos page, search and then hover over the algo and click on "view more" to see the historical backtested data. Then you need to click on "Deploy all", you will see the pre-deployment properties window in the algos page. Finally, you can set an Algo Cycle and then click on the "Take Live" button.